Accountants were paid commission to place clients into tax avoidance schemes targeted by HMRC

Victims who were put in a tax avoidance scheme later targeted by HMRC received advice from accountants who were being paid a commission.

Sky News has seen evidence of chartered accountants advising their clients to enter salary loan arrangements, run by companies that were paying them to do so.

These schemes were later targeted by HMRC, and workers were hit with giant tax bills, sometimes hundreds of thousands of pounds.

Money blog: Value of a million homes rose 50% since COVID

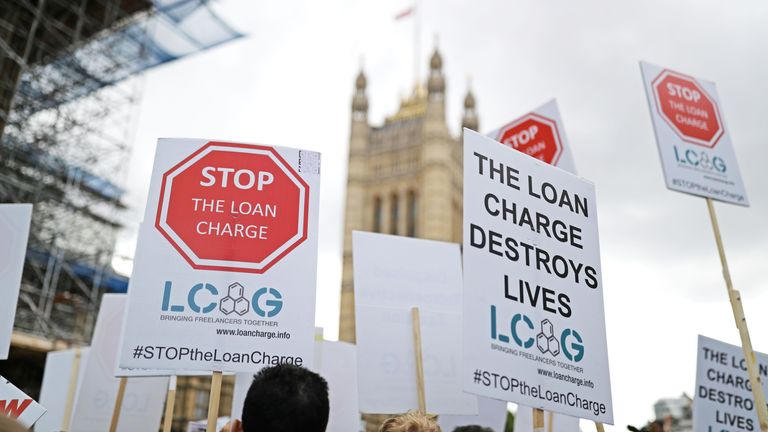

In some cases, the tax demands have been crippling. It’s a campaign that has driven people to the brink of bankruptcy, devastated families and has been linked to 10 suicides.

MPs are now calling for a public investigation into the role of accountants and other professional bodies in the proliferation of these schemes.

An independent review of the loan charge is currently under way, but it is limited in its scope.

What is the loan charge scandal?

It is the latest revelation in a scandal that has caused untold misery for tens of thousands of people, who were enrolled into tax avoidance schemes, often against their knowledge.

They included contractors who were urged to avoid setting up limited companies and to instead receive payment through the schemes, which were meant to handle their pay and taxes.

Please use Chrome browser for a more accessible video player

1:42

Loan charge scandal ‘cover-up’

They worked by paying workers what were technically loans, instead of a salary. This allowed them to circumvent paying income tax. What many assumed were tax deductions on their payslips were, in fact, fees going towards the promoters of the schemes.

Tax avoidance is not illegal, but HMRC has successfully challenged tax avoidance schemes in the courts, and workers have subsequently been asked to pay the missing tax. There is no suggestion that these accountants broke the law.

Richard’s story

For Richard Clancey, HMRC’s handling of the loan charge feels like “state-sponsored bullying”.

After being offered a contract role in 2010, Mr Clancey, now a retired computer services professional, contacted a chartered accountant in Kent to help him set up a limited company.

The accountant encouraged him to enrol in a payment scheme instead.

“He gave us an hour’s presentation on the benefits of the scheme and how it worked,” Mr Clancey said.

“This included how they would handle all administration, pay all tax that was due, was IR35 and tax law compliant, had a lower risk than using a limited company, had been approved by a tax QC and was currently used by several people who were working for HMRC.

“The presentation was very elaborate and complicated and I cannot claim that I understood it all, but I wanted to ensure I was legal and compliant, so I trusted the advice of a chartered accountant that use of this scheme was the right thing to do.”

Read more:

Rise in suicide attempts linked to HMRC crackdown

HMRC accused of ‘dangerous’ new tactics in tax crackdown

The accountant told him that he was receiving an introductory fee, but not that he would receive ongoing payment.

In 2014, Mr Clancey received an email from his accountant outlining that the previous year he had received £257 in commission. However, he did not receive statements for the previous two years.

“Although you were notified of this commission before, we are also required to declare the amount of commission to you according to the guidance of the Institute of Chartered Accountants of England and Wales,” the email read.

“This commission has not cost you anything,” it added.

The company’s former website page clearly stated that it offered accountants commission, boasting that the rates had been raised.

At this point, Mr Clancey was already on the radar of HMRC.

In 2012, tax authorities wrote to him to explain that he had been in a tax avoidance scheme that “HMRC believes does not work”. He was subsequently asked to pay more than £100,000.

“Over the next seven years, I received multiple penalties and threats from HMRC who said I had been a tax avoider who should settle their debts now or face worse consequences later,” he said.

“There hasn’t been a single day when I haven’t been consumed by the frustration and anger of my situation and how it arose… Since my involvement with [the scheme] and the subsequent hounding from HMRC and government, a lot of that has changed. This state-sponsored bullying has caused me to suffer some mental health issues.

“My personal stress levels were through the roof. I dreaded the next brown envelope coming through the post box with outrageous, unsubstantiated demands. My poor wife would apologise and burst into tears as she brought these to me.”

HMRC said it takes the wellbeing of all taxpayers seriously. “We are committed to identifying and supporting customers who need extra help with their tax affairs and have made significant improvements to this service over the last few years.”

Like others in his position, Mr Clancey is frustrated by the blunt approach of the tax authority and the lack of accountability from other parties.

“I have been increasingly concerned that my chartered accountant led me into the hands of a scam organisation,” he said.

“HMRC continues to persecute victims.”

Government reaction

The government has now launched an independent review into the loan charge, and HMRC is pausing its activity until that review is complete – but its focus is on helping people to reach a settlement.

The review will not look at the historical role of accountants, promoters and recruitment agencies, even though they propped up the schemes.

Politicians and campaigners have called for a broader investigation.

Greg Smith, MP and co-chair of the Loan Charge and Taxpayer Fairness APPG, said: “It’s clear that many chartered accountants were directly involved in the promotion of loan schemes.

“People trusted accountants and had the right to rely on this advice, and yet, instead, are facing life-ruining bills. There needs to be a proper investigation into this as part of an independent inquiry into the loan charge scandal,” he said.

“Either HMRC warned accountants not to recommend these schemes, in which case the accountants were giving reckless and potentially fraudulent advice; or HMRC didn’t tell accountants not to do this, in which case HMRC themselves were seriously at fault.

“Either way, it is quite wrong that the current government continues to only pursue those who took and followed professional advice and not those who gave it, whilst profiting from doing so.”

The experience has damaged Mr Clancey’s faith in the sector. “I will never again trust professional financial advice,” he said.

“If the advice of a chartered accountant can cause this much damage without culpability, then there is something very wrong. It is a failure on the part of the entire tax industry that accredited professionals can, through their advice, destroy the lives of the individuals that they advise.”

A spokesperson for the Institute of Chartered Accountants in England and Wales, an industry body, said: “We expect chartered accountants to adhere to the highest standards in all of their work, including tax.

“Robust rules for members performing tax work are contained in standards which have been developed and strengthened to prevent the involvement of members in aggressive tax avoidance.”

The organisation strengthened its standards in 2017, after the loan charge legislation was announced, adding that “members must not create, encourage or promote tax planning arrangements or structures that set out to achieve results that are contrary to the clear intention of parliament in enacting relevant legislation and/or are highly artificial or highly contrived and seek to exploit shortcomings within the relevant legislation”.

Anyone feeling emotionally distressed or suicidal can call Samaritans for help on 116 123 or email jo@samaritans.org in the UK.

In the US, call the Samaritans branch in your area or 1 (800) 273-TALK.