Average mortgage rates edge up again after brief fall, market data shows

Fixed mortgage rates have risen again after a brief fall, according to the latest market data.

The average two-year homeowner mortgage rate on the market edged back up to 6.8% on Friday from 6.79% yesterday, financial information company Moneyfacts said.

Five-year fixes have also risen slightly back to 6.32%, up from 6.31% on Thursday.

The fleeting dip was the first time average mortgage rates had fallen for months.

The majority of UK mortgage holders are on fixed-rate deals.

More than 400,000 people were expected to move off existing fixed deals between July and September, meaning they are likely to be forced to sign up to higher monthly repayments.

Click to subscribe to the Sky News Daily wherever you get your podcasts

On Wednesday, it emerged inflation had fallen more quickly than expected, giving a glimmer of hope for under-pressure mortgage borrowers.

Advertisement

The Office for National Statistics said the consumer prices index fell to 7.9% last month, down from 8.7% in May.

The Bank of England uses base rate rises as a tool to cool inflation.

The central bank is still expected to raise interest rates – currently at 5% – at its next meeting on 3 August as it battles to bring inflation back to its 2% target.

Read more on Sky News:

Not all shops display prices as clearly as they should – watchdog

Retail sales jumped 0.7% last month

But experts have said the bigger-than-expected fall in inflation could see the Bank’s policymakers opt for a smaller increase of 0.25 percentage points rather than another 0.5 percentage point rise.

Rachel Springall of Moneyfacts said: “The mortgage market has seen some competitive deals surface this week, but it will be down to the borrower to decide whether now is the time to grab a deal or wait and see what may surface in the coming weeks.

“There are huge hopes interest rates on mortgages will fall, but it could take a few weeks for that kind of sentiment to surface in the market – especially with another base rate decision on the horizon.”

Please use Chrome browser for a more accessible video player

2:05

Will interest rates fall?

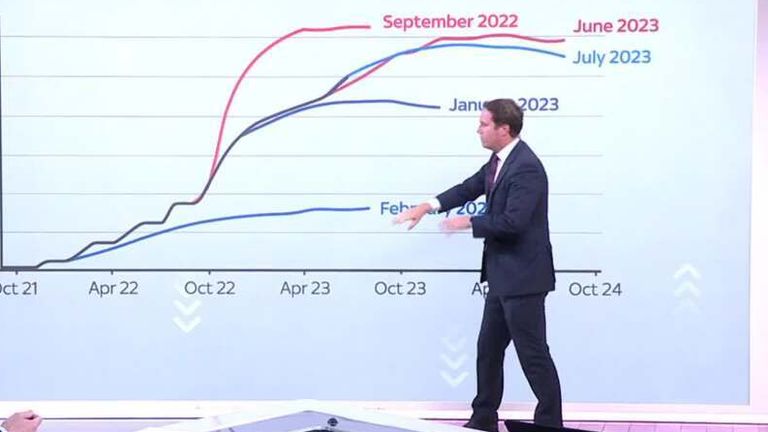

Overall, mortgage bills for anyone who has recently agreed to a new fixed rate are still up markedly from the years of ultra-low interest rates.

Less than two years ago, in October 2021, the average rate on a five-year deal was just 2.55%.

More than 2.4 million fixed-rate deals were set to expire from summer to the end of 2024, according to banking industry trade body UK Finance.