Be patient with this red-hot tech stock, as it soars to new all-time high

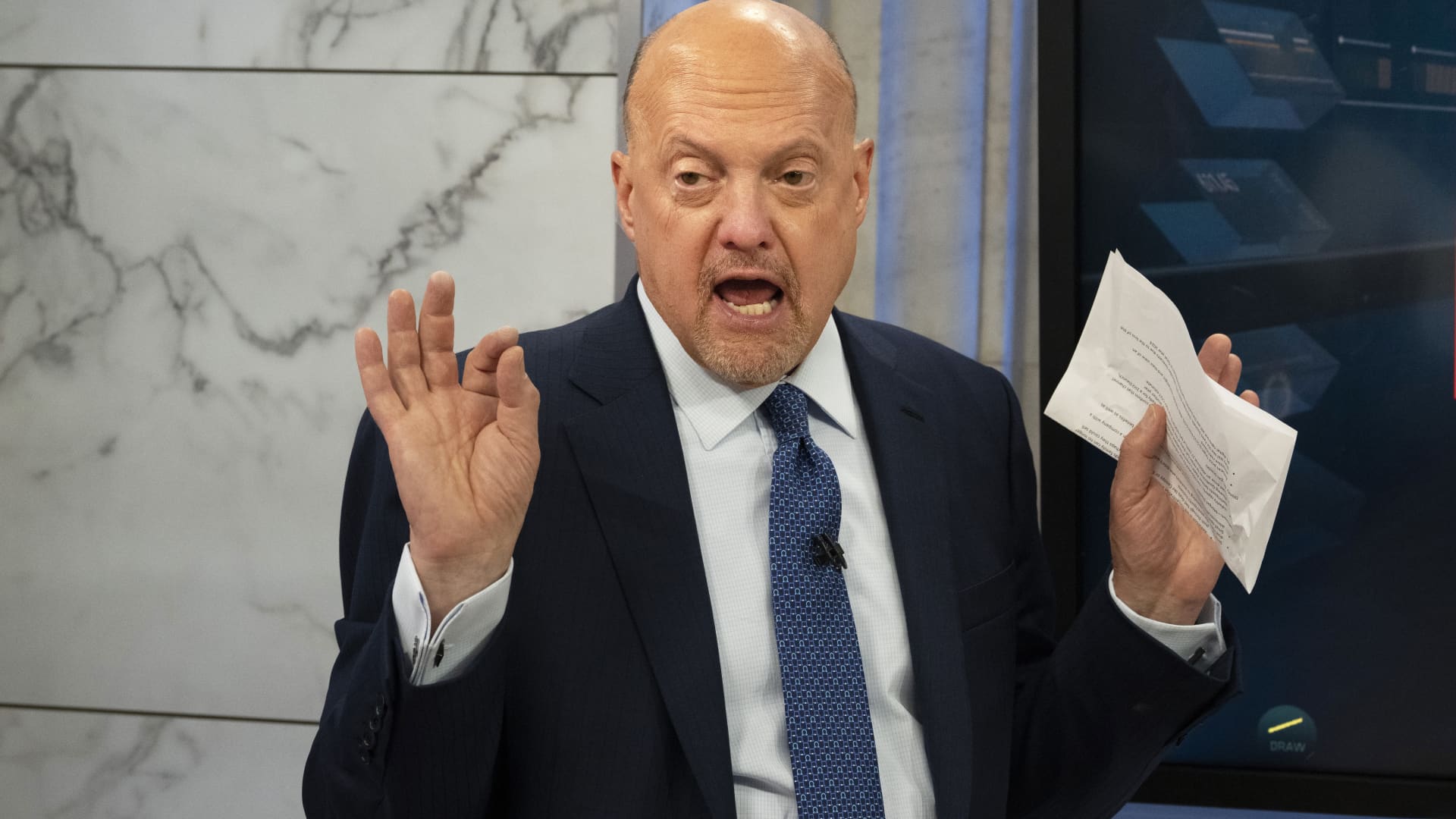

Every weekday the CNBC Investing Club with Jim Cramer holds a “Morning Meeting” livestream at 10:20 a.m. ET. Here’s a recap of Monday’s key moments. Equities down, as energy outperforms Stick with Palo Alto Networks Watch Wells Fargo 1. Equities down, as energy outperforms Stocks edged down in midmorning trading Monday, as Wall Street entered the final trading week of the first half of 2023. The S & P 500 was down 0.13%, even as energy — the index’s biggest loser year-to-date — was outperforming. The Club’s three oil-and-gas firms — Pioneer Natural Resources (PXD), Coterra Energy (CTRA) and Halliburton (HAL) — were solidly in the green Monday. The health-care sector, meanwhile, was pulled down by a more-than-5% decline in Pfizer (PFE) stock after the pharmaceuticals giant pulled the plug on a weight-loss pill trial amid safety concerns. 2. Stick with Palo Alto Networks Palo Alto Networks (PANW) is well on its way to becoming the first cybersecurity company to reach a $100 billion market capitalization, Morgan Stanley said Monday. Analysts at the firm designated the stock their top cybersecurity pick, and hiked their 12-month price target by 18%, to $302 per share. Jeff Marks, the Club’s director of portfolio analysis, said Monday that investors should be patient with Palo Alto shares as the stock hit a fresh all-time high Monday, climbing to around $247 apiece. “This would certainly be a name to turn to” if it were to pull back, he said. 3. Watch Wells Fargo Wells Fargo (WFC) will be in the spotlight after Wednesday’s close when the Federal Reserve releases the results of its annual bank stress tests. It’s been tough to own bank stocks this year, Marks noted Monday, following the regional banking crisis that started with the collapse of Silicon Valley Bank in March. But the stress tests are one of three important events the sector needs to get through, he explained. The other two are second-quarter earnings, which Wells Fargo is set to report before the bell July 14, and special fees the Federal Deposit Insurance Corporation plans to implement to help replenish its deposit insurance fund. Wells Fargo stock was up slightly Monday morning, trading around $40.60 a share. (Jim Cramer’s Charitable Trust is long PANW and WFC. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.