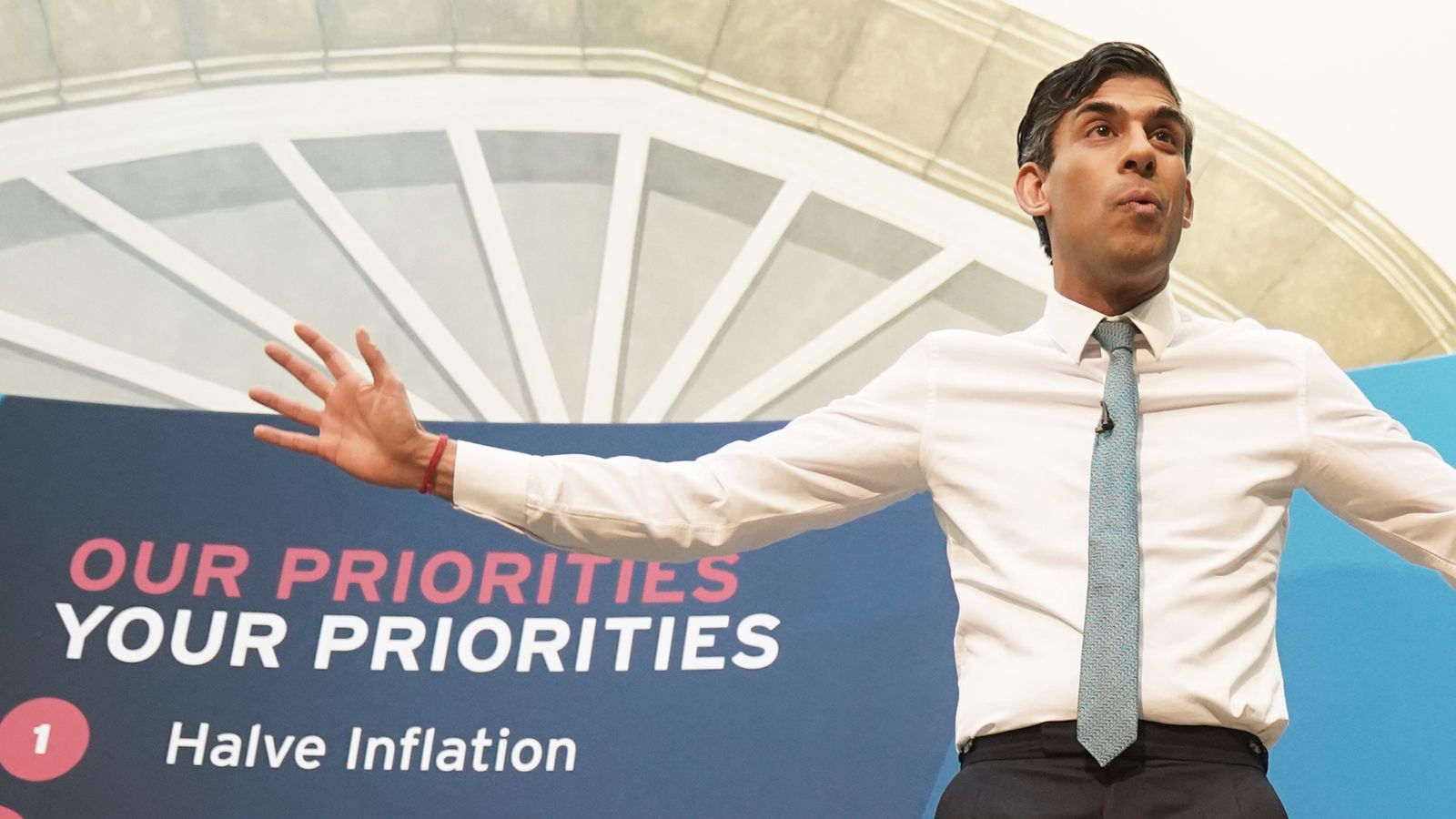

Rishi Sunak promises economy ‘going to be OK’ after shock rates rise and he is ‘100% on it’

“I am totally, 100% on it – and it’s going to be OK,” Prime Minister Rishi Sunak said this afternoon, following a shock interest rate rise to 5%, and the news that inflation was stuck at 8.7%

Mr Sunak was talking from a warehouse in Dartford, Kent, amid the latest economic turmoil.

The former chancellor has tried to project his financial nous and attention to detail as reasons the public can trust him to bring down both price growth and the Bank of England’s base rate.

Politics latest: ‘We are going to get through this’

Mr Sunak made his primary pledge at the start of 2023 to “halve inflation” from just over 10% to around 5% by the end of the year.

Speaking from the warehouse, Mr Sunak said: “Yesterday you would have heard some news about inflation, today you may have seen what the Bank of England has announced with interest rates.

“I’m sure that actually fills many of you with some anxiety and some concern about what’s going on and what that means for you and your families.

“I’m here to tell you that I am totally, 100%, on it and it’s going to be OK and we are going to get through this.”

Asked by Sky News if he accepted that his approach to the economy – keeping public pay low, shying away from tax cuts and promising to halve inflation – would hurt his electoral chances, Mr Sunak remained stoic.

Advertisement

Ed Conway: Scale of rate hike is shock therapy for UK’s inflation problem

Please use Chrome browser for a more accessible video player

11:04

How will we control inflation?

He said that meeting his target has “of course” got harder, “but it’s certainly not impossible”.

The prime minister said that the public will be able to judge him in “six months, nine months, a year” on how he is doing and whether the economy is healthier.

Earlier in the day, he said that halving inflation by the end of the year is “hard, but not impossible”.

Mr Sunak was speaking to the Times CEO summit shortly after the surprise hiking of the interest rate.

Mr Sunak said: “Clearly what’s happened in the last couple of months makes that harder, of course it does. That goes without saying. But I’ve always said this would be hard.

“It’s clearly become more challenging and it’s clearly become harder, but it’s not impossible and we’re throwing absolutely everything at it, and that’s what I’m doing.”

Interest rates are set by the Bank independently of the government and impact the cost of borrowing money, while inflation charts how quickly prices are rising.

Speaking at a by-election campaign event in Boris Johnson’s former constituency, Labour leader Sir Keir Starmer said the government “wants to pretend it’s someone else’s fault” and warned of the “lessons” of “undermining our independent institutions” after Kwasi Kwarteng’s mini-budget and its fallout last year.

“You have to ask the question why the UK is always hit the hardest – and the answer to that is 30 years of absolute failure from this government, a kamikaze budget and a failure to fix the fundamentals,” Sir Keir said.

He added that the “awful prospect” of “mortgage holders and families paying the price of Tory failure” is “completely, completely unacceptable”, citing Labour’s new five-point plan for mortgages, released overnight.

Speaking to journalists during the daily briefing earlier, the prime minister’s spokesman said Mr Bailey still had Rishi Sunak’s support.

He was repeatedly asked if the central bank chief was doing a good job in tackling inflation, but did not respond in the affirmative.

This took place shortly before the surprise interest rate hike.

The Number 10 spokesman said: “The prime minister thinks it is important that we continue to support the Bank in the work they are doing.

“You’re aware that there’s an independent process for setting interest rates, and we continue to work closely with them and work well with them to bring down inflation.”

Click to subscribe to the Sky News Daily wherever you get your podcasts

The Bank has a target to bring inflation down to 2%.