Nvidia’s blowout earnings lift AMD while other chipmakers like Intel fall

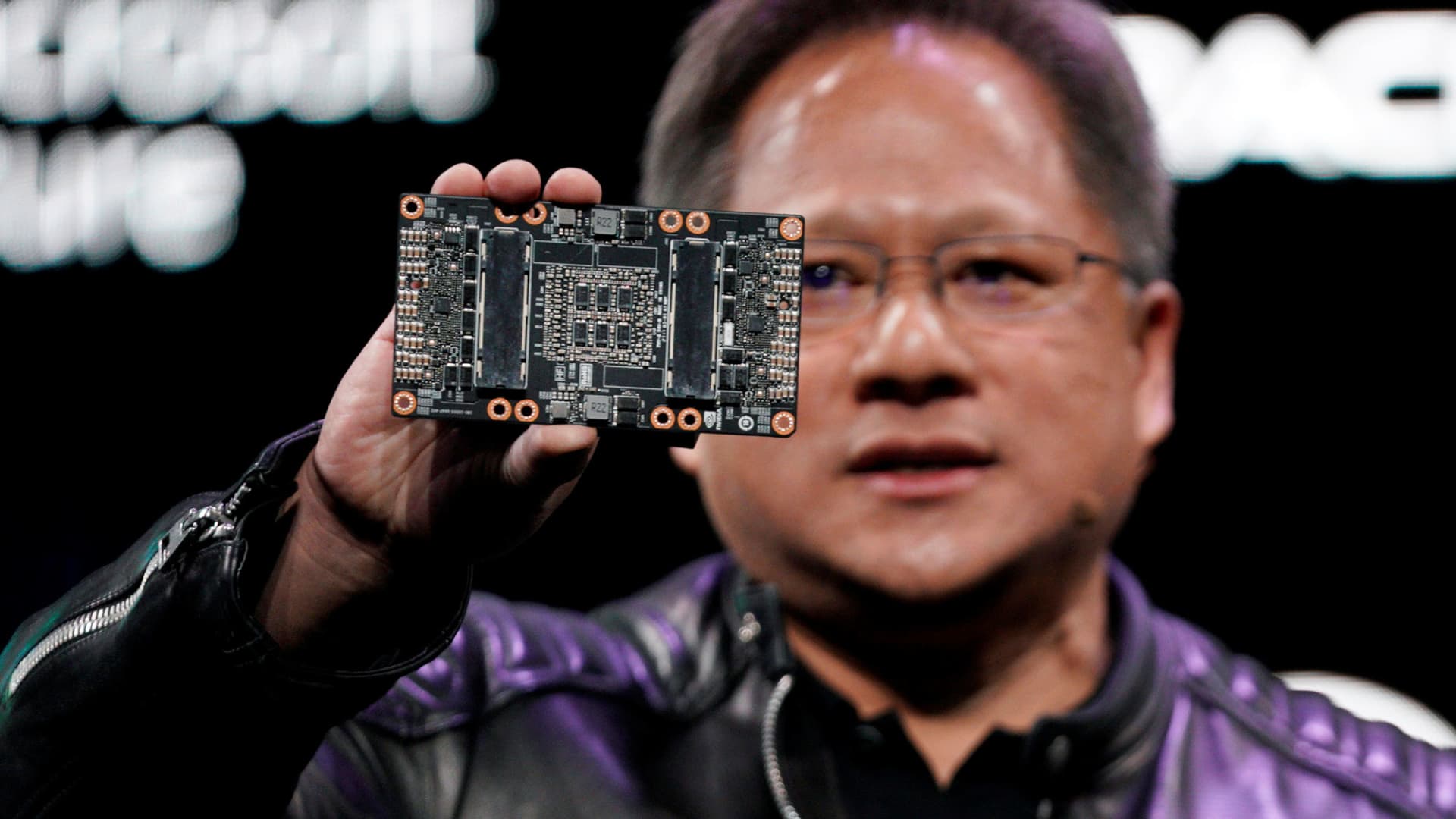

Jensen Huang, CEO of Nvidia, shows the NVIDIA Volta GPU computing platform at his keynote address at CES in Las Vegas, January 7, 2018.

Rick Wilking | Reuters

Nvidia’s gain has buoyed some semiconductor names in Thursday trading, particularly firms that specialize in AI-favored chips, while pushing down shares of other chipmakers, including Intel and Qualcomm.

Nvidia shares traded up 25% Thursday, alongside a notable 9% gain in shares of AMD. Both Nvidia and AMD specialize in so-called “discrete,” or standalone graphics processing units. Meanwhile, shares of conventional computer chip firms dipped. Intel shares were down about 6% in morning trading while Qualcomm, which manufactures mobile chipsets, slipped about 1.3%.

The wide array of price actions suggests a flight away from a traditional focus on traditional computer chips and towards GPU manufacturers. GPUs have enjoyed surging enterprise demand as startups and established tech firms scramble to build out AI platforms. GPUs are the “brains” behind large-language models and other AI technologies, helping to power OpenAI’s ChatGPT and Google’s Bard.

“Instead of millions of CPUs, you’ll have a lot fewer CPUs, but they will be connected to millions of GPUs,” Nvidia CEO Jensen Huang told CNBC.

Historically, the opposite has been true. The potential inversion may be driving the flight away from CPU names and towards Intel and AMD.

Shares of Taiwan Semiconductor Manufacturing Company also rose nearly 11%. TSMC is a key part of the manufacturing process for many semiconductor firms, which design their own chips but can rely on TSMC to handle the delicate and technical manufacturing process.

Marvell and Broadcom, which were up 2% and 3% respectively, benefitted by their exposure to cloud computing and potential AI applications. Marvell partners with names like Google, Meta, and Microsoft; Broadcom has been developing technologies to link AI supercomputers together.

The VanEck Semiconductor Index, a ETF basket of chipmaker names that includes Nvidia and Intel, rose 6.4% in Thursday morning trading.

Trading activity for Nvidia shares also boomed on Thursday. Just seven months ago, Nvidia closed at a two-year low of $112. But on Thursday, alongside beating its intraday all-time high, more than $15 billion worth of Nvidia shares changed hands.

And in the first 18 minutes of Thursday trading, the chipmakers’ stock had already passed its average full-day volume.

CNBC’s Kif Leswing and Robert Hum contributed to this report.